Based on last year’s topics of ‘Automation’ and ‘Renewable Energy’ and how businesses in Singapore, Malaysia, and Vietnam tackle their sustainability issues through these technologies, our 9th edition of exploreASEAN will take things a step further to uncover how new possibilities – enabled by emerging technologies, such as the popularity gaining Artificial Intelligence (AI) – can help businesses champion circular economy principles in Singapore, Thailand, and Vietnam.

Beyond Growth: Embracing Digitalization and Robotics in Circular Economy

ASEANs Framework for Circular Economy

The ASEAN Economic Community recognizes the inefficiencies of the current linear economic model, characterized by the “take, make, dispose” approach, leading to a resource shortage and environmental challenges. This approach threatens ASEAN’s economic resilience through resource depletion, unsustainable raw material consumption patterns, value chain inefficiencies, and climate change. To address these challenges, ASEAN adopted the Framework for Circular Economy in late 2021. This framework prioritizes creating an economy that is restorative, regenerative, and efficient in using materials and energy to retain their value. While existing Circular Economy initiatives in ASEAN have largely focused on environmental aspects, the framework outlines a long-term vision to build on existing strengths. The three strategic goals defined are “Resilient Economy”, “Resource Efficiency”, and “Sustainable Growth”. Key strategic priorities include “Standard Harmonization and Mutual Recognition”, “Trade Openness and Trade Facilitation”, “Innovation, Digitalization, and Emerging Technologies”, “Sustainable Finance and Innovative Investments”, and “Efficient Use of Energy and Other Resources”.

Innovation Opportunities of Digitalization and AI in ASEAN

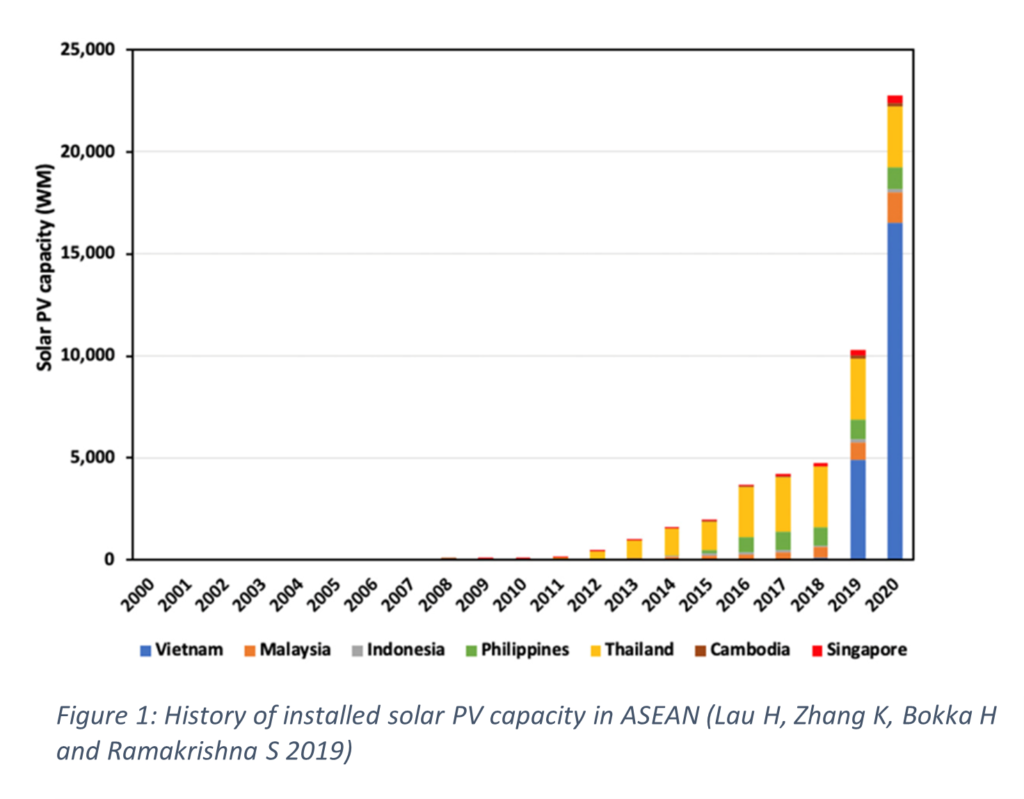

Over the past two years, AI technologies like ChatGPT have become commonplace. For businesses, adopting advanced technologies such as AI and robotics is crucial for enhancing productivity, streamlining processes, and improving efficiency. According to TECHWIRE ASIA, businesses often face challenges in fully utilizing data. Recent technological progress has given rise to smart factories where real-time data analysis and predictive analytics empower manufacturers to make data-driven decisions. This enables them to identify bottlenecks, optimize supply chains, reduce human errors, increase labor productivity by up to 30%, and improve forecast accuracy by up to 85%, as reported by McKinsey. Digitalization and robotics initiatives further address sustainability concerns by promoting green manufacturing processes, including energy-efficient methods, eco-friendly materials, and carbon footprint reduction through the breakdown of both external and internal process silos.

Why Businesses Move to the ASEAN Region

The COVID-19 pandemic accelerated digital transformation in the ASEAN region, prompting member states to enhance knowledge sharing and invest in digital initiatives. They established an ASEAN digital community across the three pillars of sustainability: People, Planet, and Profit. This transformation has made the ASEAN region highly attractive for businesses and investments. The IMF forecasts that by 2027, ASEAN’s economy will be the world’s fourth-largest, with the region’s digital economy projected to exceed a value of $1 trillion by 2030. In 2022, the region witnessed the creation of 25 new unicorns (companies valued at over $1 billion).

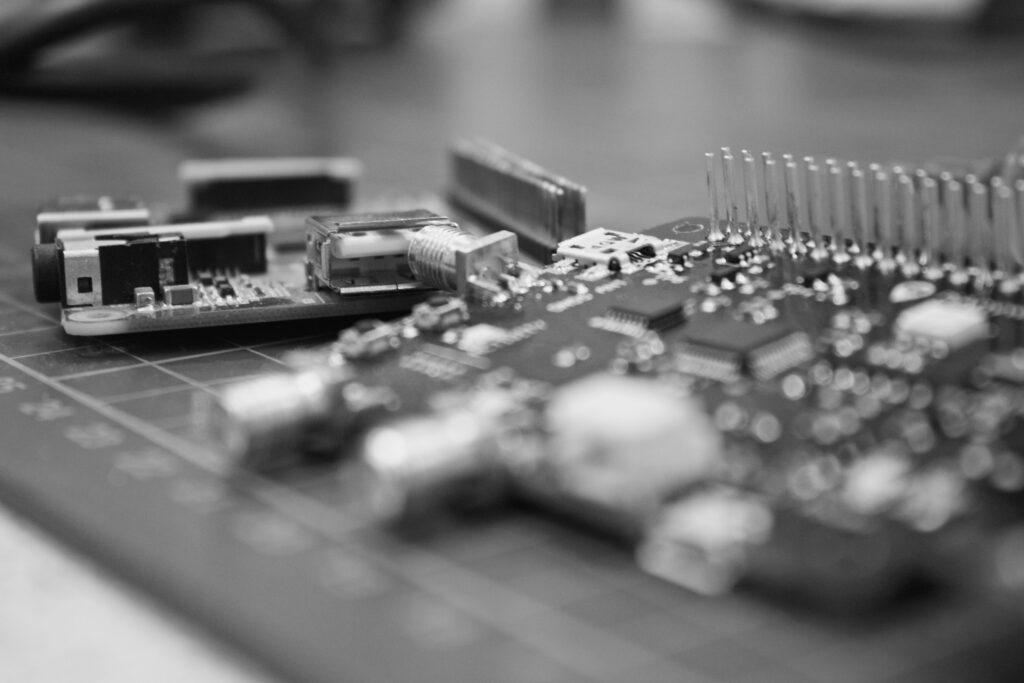

Recent developments in ASEAN countries can be exemplified by their increasing significance in semiconductor production and various investments in this area. In this regard, a noteworthy event was the recent visit of U.S. President Joe Biden to Vietnam on September 10th. This visit resulted in the introduction of semiconductor workforce development initiatives, supported by an initial seed funding of $2 million from the U.S. government, along with significant investment deals in the billions to boost investments in Vietnam. Another key player in the world of semiconductors is Singapore, renowned for its production of specialty chips. This niche industry will continue to grow in importance, particularly due to advancements in 5G, the automotive sector, and the Internet of Things. In fact, the city’s semiconductor output currently constitutes 11% of the entire global market, as reported by EDB Singapore. Notably, numerous countries, including the United States, Japan, and the European Union (EU), are offering billions in chip subventions. Recently, the U.S. company GlobalFoundries announced a $4 billion expansion of its existing microchip plant in Singapore. This underscores the growing importance of the semiconductor industry in the ASEAN region and its contribution to global technological advancements.

In both our Seminar in Switzerland and our On-Site Seminar in Vietnam, Thailand, and Singapore, we will delve into how companies integrate these digital transformation initiatives along their value chain to champion circular economy practices. To stay updated with our latest information, visit our website.

With its multifaceted appeal and investments in green innovation, ASEAN has emerged as one of the most attractive regions for businesses expanding abroad. Would you like to be part of our journey? Apply to join our Delegation today! For more information, visit our Social Media Channels: LinkedIn, Instagram, and Facebook.

This International Student Project would not be possible without the generous support of our Partners and Sponsors. If you wish to become a Partner access benefits such as access to an exceptional talent pool of our student delegates, don’t hesitate to contact us here!

Your 2023/24 exploreASEAN Team